Image via Wikipedia

Image via Wikipedia

So imagine my surprise when HSBC summarily canceled my account due to inactivity. Da noive a dem bums!

But HSBC's actions are part of a larger trend, with most credit providers culling inactive accounts from their ranks in order to reduce expenses and the risk of fraud.

It's more than blow to your ego, however--it's also a blow to your credit score. When an account is closed, your total available credit goes down with it, thus worsening your credit utilization ratio.

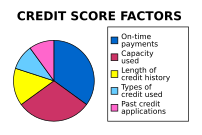

Your credit utilization ratio -- the amount of your debt in relation to the amount of your available credit -- comprises 30% of your score, says Craig Watts, a spokesman for Fair Isaac Corporation (FIC), the company that calculates and issues the FICO credit score that most lenders use. So when an account is closed, you have less credit available to you -- and the ratio immediately jumps higher. A person with a solid credit score of 720 or so, whose utilization ratio jumps from 35% to 75% after one of their accounts is closed is likely see their score drop by "several dozen points," to somewhere in the 600s, he says. That's a far cry from the 760 (or higher) consumers need to get the best rates from lenders.

Of course, credit card companies are not open to negotiation. All they will tell you is that you're free to re-apply for a credit card. But that's cold comfort if your score makes you unworthy -- thanks to their actions no less.

Lenders have too much power in our system for consumers to be able to fend for themselves. And a good credit score is critical to everything from buying a new suit to renting an apartment in a big city.

Which is why, with so much of the economy being driven by consumer spending, and consumer spending so closely tied to credit, the federal government should step in and tip the scale in favor of consumers.

A couple of things might help:

- prohibit credit card issuers from raising rates on pre-existing balances. If they want to raise rates going forward, fine. But the same rules should apply for buying a PC with a card as do for buying a car through GMAC. The rate I get is the rate I pay for the term of the loan;

- prohibit issues from closing accounts due to inactivity, unless those terms are stipulated in the initial contract, and are made clear from the get-go. No fine print excuses allowable. And issuers have to warn consumers if such an action is imminent.

- Stop issuers from raising rates because of a consumer's actions on other cards. I shouldn't be punished by an issuer that I haven't harmed.

Now that's one way to reignite consumer confidence for the long haul.

No comments:

Post a Comment